| Service Oriented Enterprise |

|

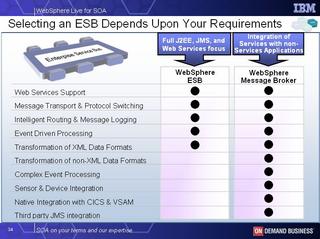

Saturday, September 24, 2005 Which IBM ESB? IBM has been beaten up by the press and blogging community for having two ESB's. Here's how I look at it. One is for new customers and new installations (WebSphere ESB) and one is for the legacy upgrade path.  posted by jeff |

2:32 AM

posted by jeff |

2:32 AM

Friday, September 23, 2005 Google Flow and Goolge Forms I believe it was 1994 - maybe 1995 when I last talked with Eric Schmidt. I asked him a very direct question, "What is the killer app for the Web?" and he responded, "Groupware". Perhaps that was the Novell corporate line - but honestly, I think he believed it. For those who don't remember - Groupware was a term that involved electronic forms and workflow/collaboration. I've been reading about Google becoming a business computing platform. If Google wants to be a business computing platform, they need two things: flow.google.com forms.google.com  Of course, this moves them from 'unstructured' data to 'structured' - and implies that Google attacks the identity / role problem. But let's get real - most business systems capture data, store it, aggregate it and redistribute it. During the process we monitor it and report on exceptions. The world has been waiting for a clean simple way to do these common tasks. Google is in an excellent position to enable business 'Software as a Service'. The traditional problem with this approach has been accessing the data once your 'SaaS' provider collects it. Well, Google clearly understands that SOA and Web services provide a real nice vehicle for facilitating data transfers. Come on Google - make my day. posted by jeff | 6:30 AM Tuesday, September 20, 2005 SAP, IBM, Microsoft and Oracle The 4 major enterprise ISV's have created their strategy. If you haven't been paying attention, I'll summarized it for you: Microsoft - Microsoft will make the WS-* protocol ubiquitous by pushing them into the operating system. Then, they will provide unbelievable tooling (Visual Studio) and a firm foundation (Communication, Presentation, etc.). This strategy is developer focused, once again hoping to create an ecosystem of applications sitting on top of their platforms (Foundation, .Net core and Windows). How will these applications get funded? Most likely a combination of new VC money, MS funded entities and internal projects. SAP - SAP has such a huge footprint inside of large enterprises that it makes it almost impossible to remove. SAP has to keep up with the trends: Provide an application platform (NetWeaver), service enable their system (ESA) and create an ecosystem (Xapps). Done, done and done. SAP has protected their market. Oracle - Oracle looked like the dog in the group - until they bought out all of their competition. Less SAP, Oracle owns the application space. This means that they are concerned about the business services and processes. Does it matter if it runs on Oracle App Server or IBM WebSphere? No way. Everyone knows that the J2EE stack is commoditized - just ask JBoss. Oracle will use the WSDL as the new 'barrier to removal'. IBM - At first glance it would appear as though IBM is the ultimate loser. They have lost the Application space to SAP and Oracle. Their WebSphere suite is commoditized which leaves them with two interesting items: Traditional IGS consulting and Business Process Outsourcing. From my view it appears that IBM wants BPO. They'll own your technology because they'll own your outsourced process. Who wins? This is a huge, huge gamble that IBM is taking. If BPO goes 'out of style', IBM will find themselves with no application strategy and playing second fiddle to the Microsoft tooling and platform. Ouch. On the other hand, if their bet plays out they will have the ultimate hand in deciding which vendors technology is used. Oracle has a massive integration project in front of them. SAP will find that it is hard to swap out the platform foundation for their ERP suite. Who wins? All of them - to some degree - no clear winner - all advance. Who loses? This is easy. Anyone that isn't SAP, Oracle, IBM or Microsoft loses. We aren't done consolidating so some additional companies will have interesting exits, but ultimately the consolidation favors the giants. posted by jeff | 4:56 AM |

|

|||||||||||||||

|

|

||||||||||||||||